J2R

J2R

Music is a powerful cultural element that captures and influences the zeitgeist. Artists utilize music as a vehicle to articulate stories and express profound emotions. Meanwhile, consumers form deep emotional connections with their favorite artists and the songs they create. Music is unique in that it transcends cultures, languages, and time.

Universal Music Group (OTCPK:UMGNF) monetizes the world’s music and serves a crucial role in this music ecosystem. It is the global leader in recorded music and owns the second largest music publishing company. At its core, the firm develops, acquires, and stewards music IP by funding artists to produce music, purchasing catalogs, and administering copyrights.

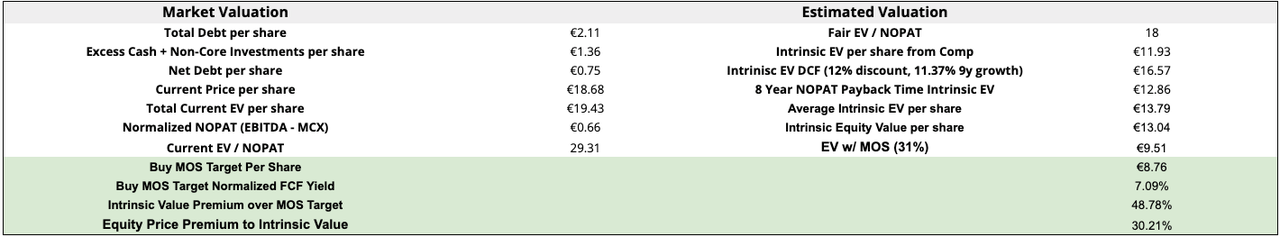

I believe UMG is currently worth an intrinsic equity value of €12-14 per share. With a modest MOS (Margin of Safety) of 31% and a 12% discount rate that reflects minimal business and financial risk, my buy target price is between €9-€10. The current market price of €18.47 per share reflects a significant premium over this target, so patience is required to start a position. This valuation does not factor in the risk that the copyright reversion provision from the US Copyright Law of 1976 may enable artists to reclaim their copyrights after 35 years. I need to see a resolution to this legal battle before committing significant capital. The MOS target price provides adequate downside protection for the following risks:

Increased Bargaining Power of Artists

Increased Bargaining Power of Spotify

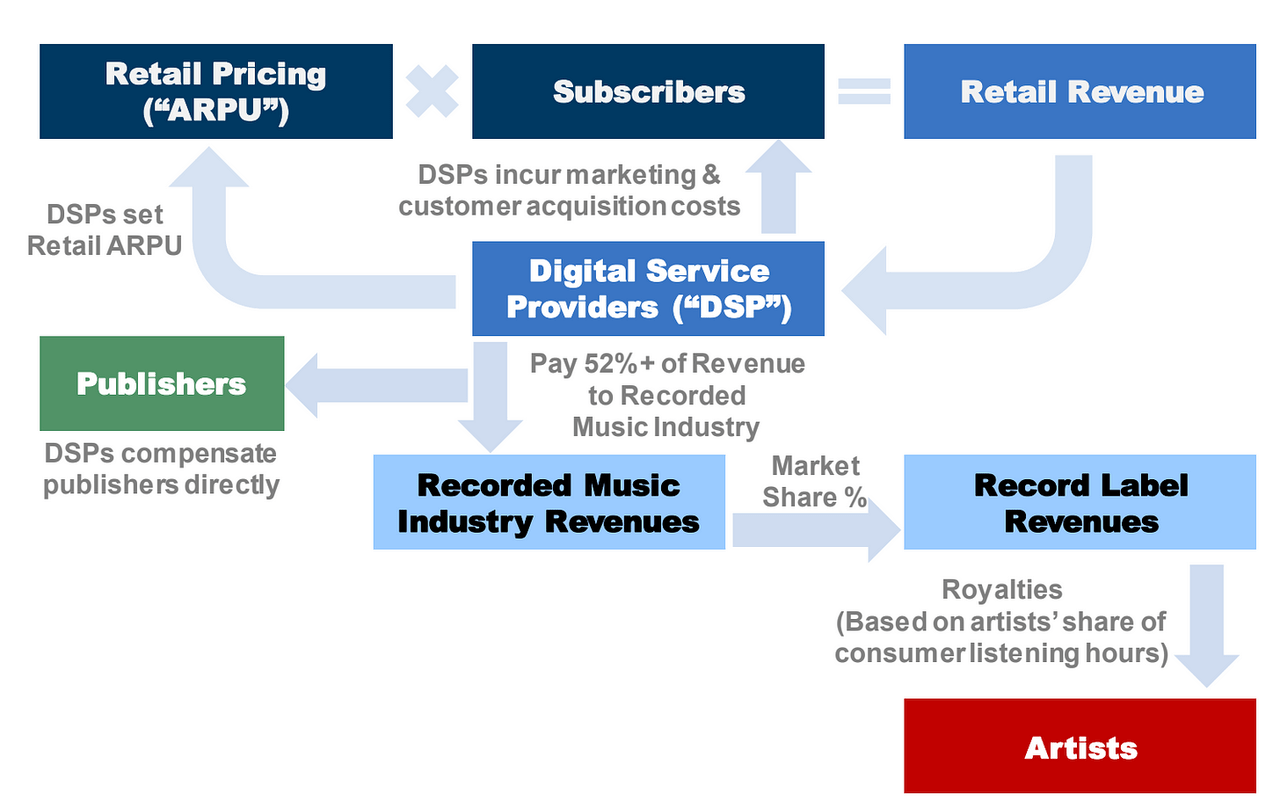

Paid Music Streaming Flow Overview ($PSTH Music is Universal Presentation)

Paid Music Streaming Flow Overview ($PSTH Music is Universal Presentation)

The business owns and manages recorded music and composition rights. When a person listens to, purchases, or streams that music, the distributor must pay UMG directly or indirectly through a collection society. Interactive platforms such as Spotify, Apple Music, or Amazon Music enable consumers to stream music at home or on the go. These applications allow users to select and listen to songs, create playlists, and discover music. The Digital Service Providers (DSPs) pay roughly 70% of their subscription and advertising revenues to labels and publishers. Zooming in, they typically send $0.50-$0.55 of every $1 generated to the record labels and $0.10-$0.15 to publishers The business pays a royalty fee to the musician or writer after receiving the funds. The nature of these contracts and payment terms vary widely. For the IP it does not own, Universal will set up distribution, administration, marketing, artist, and label services with counterparties, taking a cut of the revenue streams.

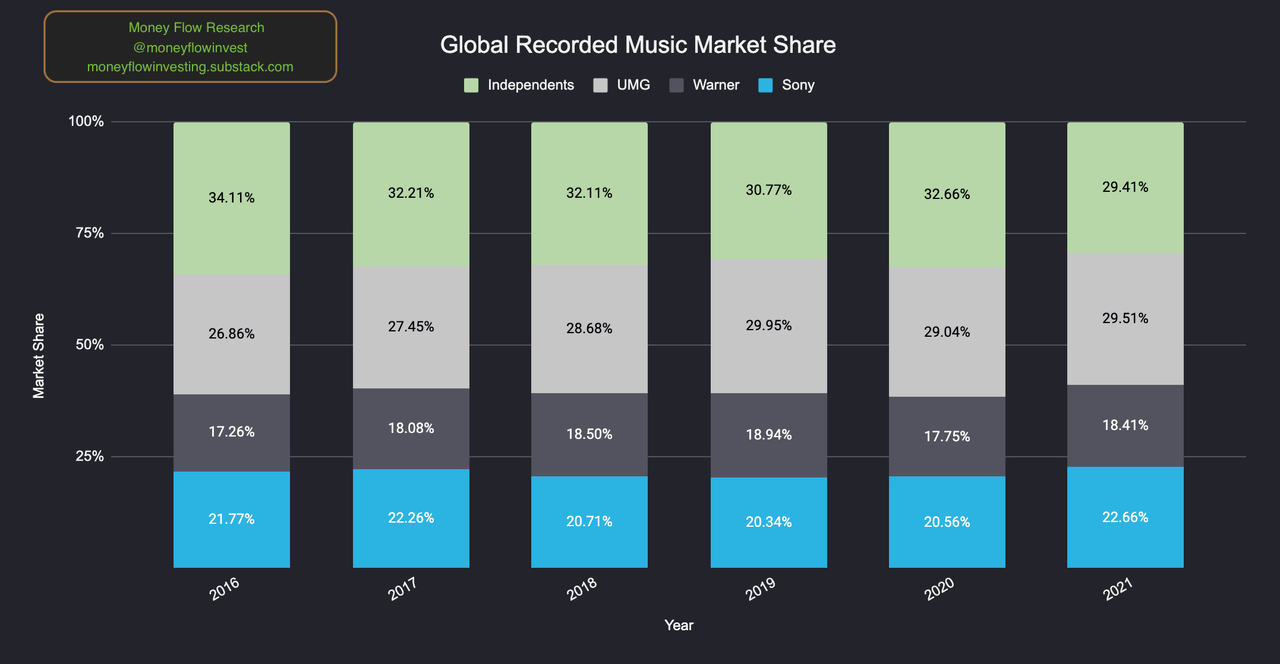

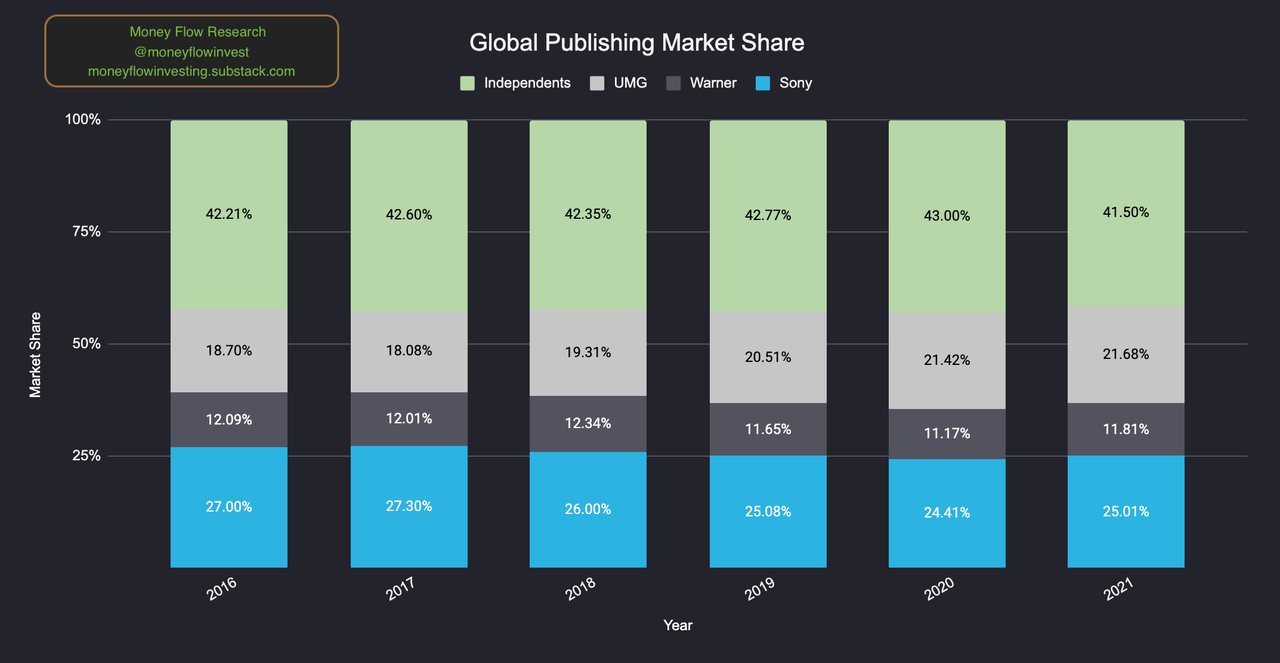

Sony Music (SONY) and Warner Music Group (WMG) are UMG’s main competitors. The three Majors represent ~70% and ~60% of the recorded music and publishing markets, respectively.

Global Recorded Music Market Share (IFPI - SEC Filings)

Global Recorded Music Market Share (IFPI - SEC Filings)

Global Publishing Market Share (musicandcopyright.wordpress.com - SEC Filings)

Global Publishing Market Share (musicandcopyright.wordpress.com - SEC Filings)

Despite fierce competition, the company expanded its market share, proving this value proposition. For example, between 2016 and 2021, the business increased its recorded music and publishing market share by 2.6% and 3%, respectively.

The industry is currently riding the wave of growth precipitated by the increased penetration of streaming, which represented only 4% of recorded music industry revenues in 2012 and rose to 65% in 2021. This structural change radically transformed the business’s underlying economics and earnings quality. This shift has increased the value of the catalog, reduced seasonality (earnings spread out more evenly across quarters), elevated earnings visibility, and fundamentally improved the overall profitability for rightsholders.

Universal Music Group’s durable competitive advantage comes from a fragmented group of buyers and suppliers entirely dependent on its business. These stakeholders would suffer significantly if the company were to withhold its intellectual property and extensive resources. Distributors need its content to stay in business. Artists need the scale of UMG to get promoted and distributed in a fragmented environment.

There are substantial switching costs for DSPs who need UMG’s irreplaceable iconic IP. The company flexes its bargaining power the most in its relationship with DSPs. While at first glance, the music streaming business may seem similar to SVOD (Streaming Video on Demand) and AVOD (Advertising Video on Demand). In reality, there are critical differences. For a video streaming business like Netflix, its customers simply need enough entertaining content in its catalog and its pipeline to keep them around. It does not need all of the TV shows and movies created over the past few decades to keep customers returning. A DSP like Spotify requires a significant portion of its content to stay in business because consumers develop deep sentimental bonds with songs. The iconic IP UMG owns is not replaceable, and people expect all of the songs they love on the platform. Customers would leave a streaming platform if any of the Majors were to pull its entire music catalog.

More broadly, there is no threat of substitution for music. Humans have always valued music since the beginning of time. UMG controls almost a third of the music people listen to in the developed world and a sizable portion in the developing world. Although Spotify has roughly 30% of the global streaming market, the retail music industry is relatively fragmented, with the following four top competitors commanding a combined ~50% share. Additionally, the barriers to entry are low to start a streaming service. UMG licenses its music to hundreds of retailers around the world.

These factors raise the stakes for DSPs to keep the labels happy and not poke the bear. An excellent example of the labels’ power over DSPs was the launch of Spotify for Artists in 2018. This new feature was a significant threat to the record companies since it enabled independent artists to upload their music directly to the platform. The incentive for artists was to receive a more attractive deal with a higher take rate and better copyright ownership terms. After the Majors pushed back, the company shut down the service only months later.

UMG artists have narrow to moderately strong switching costs. The firm has unmatched resources, scale, and experience in the industry that offers both new and established artists the best pathway to elevate their careers. Once a record deal has expired, an artist is free to distribute to DSPs directly or change its partner. The rise of streaming and technological distribution capabilities through platforms such as CD Baby or TuneCore have enabled artists to DIY (Do it Yourself) and upload music to streaming services. A partnership with an independent label may offer a more attractive royalty rate or copyright ownership terms. UMG’s peers regularly compete for talent and will compete to make deals with stars. In other words, there are other alternatives. However, Universal Music Group’s economies of scale and position in the marketplace mean that choosing any of these options comes at a significant opportunity cost that offsets the benefits.

Let us first examine the artist’s ability to DIY. Since the technology to distribute directly is ubiquitous, anyone can upload music. This low barrier to entry has resulted in a substantial volume of new songs uploaded daily. Nearly 60k songs are uploaded daily. This immense volume of uploads suggests it is more of an uphill battle than ever before to capture the audience’s attention amongst a sea of other songs. A music label provides a musician’s marketing and promotional resources to stand out from the crowd. According to J.P. Morgan Cazenove’s 2019 UMG research report, the probability of success without these resources is exceedingly low.

Furthermore, an artist is at financial risk when going at it alone. Similar to a VC fund injecting cash into a tech startup, a label provides artists with upfront funds in the form of an advance to cover expensive production, touring, and other related costs required to cultivate a successful career. These advances are similar to loans because they are recoupable or paid back from revenues. However, the artist is typically not required to pay back the advances if things do not work out. This dynamic shifts the downside risk away from the aspiring superstar to the organization.

Partnering with an independent label is attractive since this option seemingly provides the similar benefits that one of the Majors provides while simultaneously granting better terms. The problem with this option is that the big three record companies have a superior unique value proposition compared to their smaller counterparts. A deal with a Major means that an artist receives a one-stop-shop dedicated, passionate, and experienced team helping to build their career. At the same time, they have a global scale, a larger network of relationships, and a more extensive distribution system that is simply not available to the other firms. They also have more options to drive further monetization of the content. For example, the Majors have partnerships with household brands, social network platforms, video game companies, and movie studios. Even if an independent label can procure similar deals, the Majors have more leverage since they own and manage a large percentage of the consumed music. Thus, they can demand higher fees for their artists.

If going direct or signing with an Independent has significant drawbacks, why not sign with one of the other Majors? The core reason has everything to do with the company’s vast resources and scale. Its recorded music market share is 30% larger than Sony, the next largest record label. This size gives it an advantage. With a physical presence in 200 geographic markets, the business has a significant footprint worldwide. Warner Music operates in only ~70 markets. This reach gives the artist a critical edge compared to peers at competing labels as the company can amplify the local success of an artist from one region to the rest of the world. Artists know that the brand represents a best-in-class partnership.

The domination translates to a healthy operating margin and sizable revenue lead compared to its peers. In 2021, it had a 16.45% margin compared to 11.5% for WMG. While Sony Music has a 2.75% edge in operating margin, Universal generates 20% more sales when considering the recorded music and publishing segments.

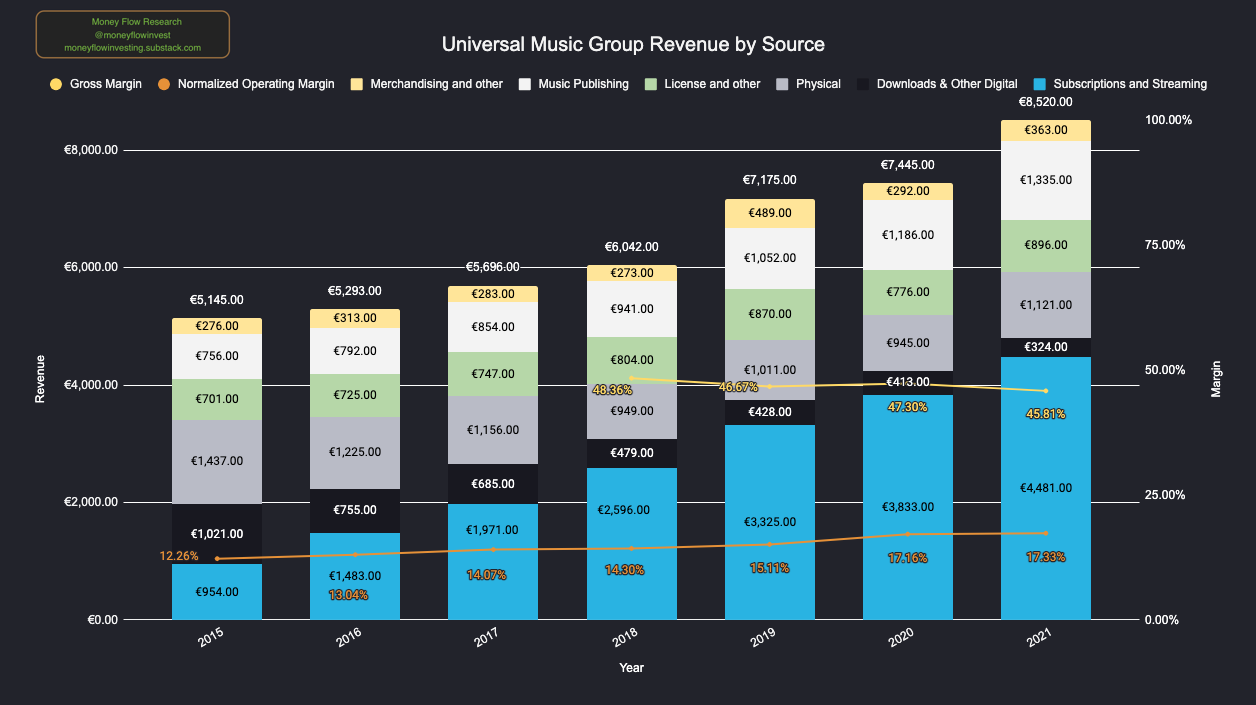

UMG Revenue by Source/Profitability (SEC Filings)

UMG Revenue by Source/Profitability (SEC Filings)

The company’s supremacy shows up in its excellent profitability record. Its strong market position and iconic IP enables it to have a stellar take rate on its net revenues, which translates to a healthy gross margin of ~46%. Driven by powerful industry tailwinds from streaming and an advantaged competitive position, UMG has robust sales, FCF, and Owner’s Earnings three-year growth rates of 12.19%, 20.95%, and 16.5%, respectively. Return on Tangible Capital* was 12% in the last three years.

* Catalog Asset Value on BS (€2.9 billion) Adjusted to Reflect Conservative Estimated Replacement Cost (~€14 billion). This reflects a ~19x FCF multiple based on estimated catalog cash flows.

Section 203 of the US Copyright Law of 1976, known as the “second chance provision,” is potentially a substantial problem for UMG. The law empowers songwriters and recording artists to terminate their copyright transfer agreements after 35 years. This termination right applies to the sound recordings and music compositions made after 1977. Section 304 covers songs written before 1978, stipulating that artists may reclaim their copyrights 56 years after publication dates. While this decree only applies to the US, it is potentially a catastrophic blow to the company and the other labels that generate millions of dollars from their catalogs. However, UMG is contesting the artists attempting to exercise their rights. The firm believes it can keep the vast majority of its US copyrights because the reversion law does not apply to “works made for hire.” In other words, the label is technically the copyright owner if it employs the musician to produce songs for the company. UMG’s 2021 Annual Report states that most contracts have a “works made for hire” clause.

Ultimately, the result of this case will thoroughly shake the industry. Although UMG believes it has a rock-solid case against artists, in my view, the outcome is highly uncertain. If the company were to lose the case, it would lose substantial amounts of money from copyrights published over 35 years ago and continuously lose the rights to songs as they expire. UMG could continue monetizing the songs it loses by renegotiating new contract terms. However, the new terms would be highly unfavorable to business compared to the previous ones due to the significantly improved bargaining power of the counterparty at that career stage.

The most meaningful pushback against Universal Music Group’s business prospects is that streaming technology has empowered musicians to bypass labels and go direct to fans. In the era of physical copies, there was a high entry barrier to reaching a large audience, and artists had little choice other than to get a record deal. There are a few reasons for this. First, the Majors held key relationships with promoters and disc jockeys on radio stations whose job was to turn songs into hits. Without access to strategic marketing channels, achieving the level of popularity required to sell many records was not simple. Second, the aspiring artist had to produce enough physical copies to meet demand. The labels had the scale and infrastructure to manufacture and distribute.

In the digital age, these reasons are less relevant. DIY distribution platforms such as TuneCore and CDBaby make it simple to upload tracks to the DSPs. The pervasiveness of social media has allowed artists to have direct relationships with fans. This structural change means that artists are increasingly either becoming successful on their own or negotiating much better terms, including higher royalty rates and continued ownership over masters and publishing rights.

Mitigant: Drowning in a sea of songs, artists remain a highly fragmented group selling into a concentrated group of buyers

The fact that it is easier than ever to upload music to streaming services and have direct relationships with fans means that everyone has the same advantage. New and established musicians must continually contend with a steady inflow of new competition. Music fans have endless choices in an oversaturated market with a catalog of 70 million songs and an average of 60k songs uploaded daily. Competition comes from all sides. Artists still depend on UMG to stand out from the crowd and take on the upfront financial risk.

Streaming’s effect on increasing the take rate is a good trade-off for UMG. While the business must give up some ground in the royalty and ownership terms it grants, its revenues and operating margins are significantly better than in the old one-time payment model. This mutually beneficial value exchange is evident as operating margins rose 3% despite declining gross margins.

Spotify’s rapid rise threatens the dominance of UMG. The Swedish firm grew its revenues from $2 billion in 2016 to $11 billion in 2021, which surpassed Universal’s run rate of $9.7 billion. More importantly, UMG is becoming increasingly reliant on Spotify for its sales. Approximately ~66% of UMG’s recorded music revenue comes from streaming. Additionally, 50% of publishing sales originate from digital sources (including social media and digital downloads). Assuming 40% of publishing comes from streaming, roughly 18% of total sales are from Spotify5. If Spotify disappeared, the nearly ⅕ reduction in sales would materially harm the business.

Mitigant: Spotify’s Future Growth is Entirely Dependent on the Majors

While Spotify has grown to become a sizable percentage of Universal’s revenue, it is far more dependent on the label than the other way around. Without UMG and the other Majors, the retailer would cease to exist. This statement may sound like a bold claim, but the DSPs need all of the music from the three major labels to survive. The IP held by the Majors is iconic and irreplaceable. There is no substitute for the legendary songs The Beatles, Bob Dylan, Queen, The Rolling Stones, and many others crafted. If Spotify attempted to disintermediate its suppliers, the “music cartel” would shut down their licenses in current and new markets and then shop them to other retailers looking to take market share. Although withholding the licenses would impede UMG’s growth temporarily, the subscriber growth would eventually come from other retailers. As mentioned earlier, an excellent example of this asymmetric power differential is the Major’s clout to shut down the Spotify Direct feature quickly. This complete reversal is a testament to the power of UMG and the other leading suppliers over Spotify.

UMG’s Valuation (Author Projections)

UMG’s Valuation (Author Projections)

A triangulation of intrinsic value using moderately conservative assumptions for Universal Music Group shows that it is roughly worth an intrinsic equity value of €13.04 per share. My valuation range is between €10.73 and €14.41 for my bear and bull cases. A 31% MOS and 12% discount rate is at the low end of my valuation hurdle. This reflects my belief that there is minimal business and financial risk in the underlying business aside from the Copyright Reversion uncertainty.

Unfortunately, the market has similarly high expectations for the company with a normalized FY 2021 FCF yield of 3.30%. It is willing to pay a hefty premium for a business with low debt in a rising interest rate environment, high earnings visibility, robust earnings power, and years of growth ahead. Mr. Market’s willingness to pay a high multiple may prevent me from buying in at the little over 7% cash flow yield I desire, but I am willing to wait.

Universal Music Group is a wonderful company with superior management that can compound shareholder capital even if it stops signing new artists and acquiring catalogs. The risk of a permanent capital loss is low considering the minimal net debt, high free cash flow, and the lack of a viable threat of substitution. I will start unloading the truck by purchasing shares and selling puts for around €10-€11 per share. However, I am not interested in doing this until the Copyright Reversion issue is in the rearview mirror. An unfavorable outcome would provide too much uncertainty around future cash flows unless management comprehensively outlined the depth of the impact and could accurately account for it in my model.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.