Warner Music and other major labels are profiting from a medium they once tried to stop.

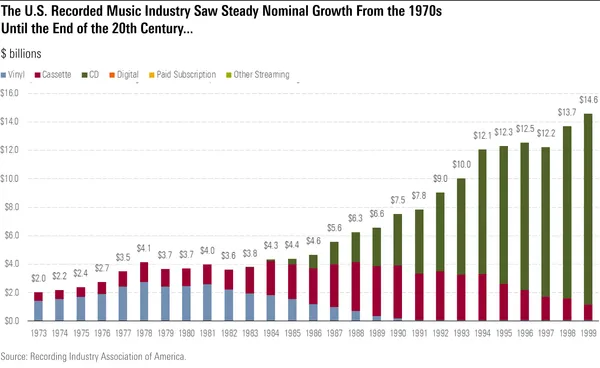

Back when records, tape cassettes, and compact discs were the most common ways to play music, major labels like Warner Music, Sony Music, and Universal Music were consistently bringing in more profit than the year before.

That dominance faced major challenges at the turn of the 21st century as services like LimeWire and Napster gave listeners access to digitally stream their favorite songs-often for free.

Sure, the audio quality wasn’t always as crisp. And a person might spend hours downloading a file just to find out it was the completely wrong one. But the future had begun, and the three major labels were getting left behind.

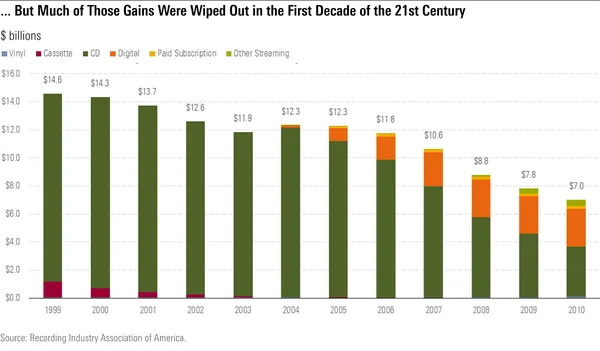

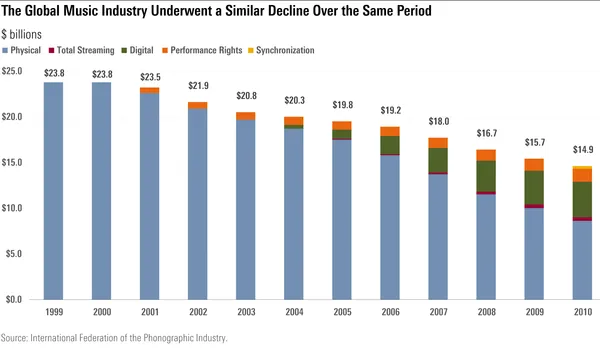

A Morningstar report entitled “Streaming Calms the Rough Seas of the Music Industry” details how Warner, Sony, and Universal saw large profit gains for the last 25 years of the 20th century, only to see sales be cut in half a decade later.

“Despite the much poorer quality compared with CDs, consumers were more than willing to make the price-versus-quality trade-off,” writes Neil Macker, senior equity analyst at Morningstar, in the report. “The industry attempted to put the rabbit back in the hat by suing services like Napster and LimeWire for copyright infringement, but despite winning against and shutting down almost every service, the Recording Industry Association of America could not stop new piracy sites and avenues from popping up.”

In just a couple of years, millions of music listeners around the world had already gotten used to the idea of having up to 100 songs-which was impressive for the time-in their pockets and even more stashed away on their personal computers.

Thus began the era of streaming and a new opportunity to capitalize.

As technology has evolved, the entertainment industry has found many ways to adapt.

For example, while there’s currently only one Blockbuster left in operation in the United States, there seems to be a new streaming service coming out every other quarter. So, while video rental is all but extinct, film studios such as Disney (DIS) and Warner Bros. are still pushing forward and finding avenues to reach their audiences in their living rooms without missing a step.

After a decade of fighting to end widespread music piracy and hoping that selling ringtones would be their salvation, the music industry is no different.

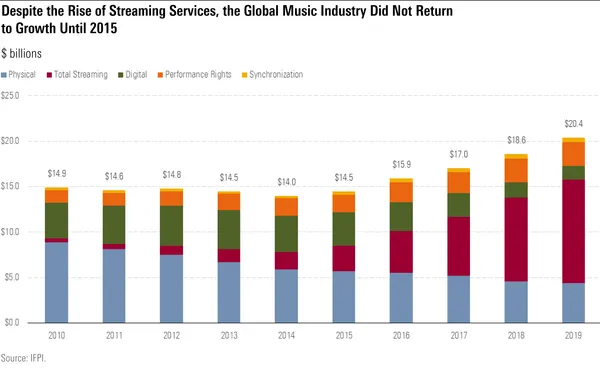

By 2010, streaming services like Spotify and Deezer each had over 7 million and 16 million users, respectively, and didn’t have to worry about claims of copyright infringement because the music was being streamed legally.

To double down on the streaming movement, Universal Music Group and Sony Music partnered with YouTube to create Vevo. Warner would soon follow suit and broker a deal to allow YouTube to stream music as long it received ad revenue in exchange.

The U.S. music industry continued to struggle until it bottomed out at $14 billion in revenue in 2014. Then, as streaming became a much larger part of the industry’s focus and physical sales dwindled in comparison, revenue started to trend upwards and hasn’t looked back since.

And Morningstar analysts expect it likely won’t for years to come.

The three major labels have fully committed to music streaming as the format for the future, and for good reason-at least in the U.S., as physical sales remain consistent in other parts of the world.

Despite early suspicions that streaming would give independent artists and smaller labels an advantage against the titans of the industry, Warner, Sony, and Universal still control more than 67% of the recorded music industry and 57% of the music publishing industry.

This placed the three in a prime position to use their greatest asset-capital-for future gains.

“The Internet, along with cheap and widely available digital tools, has made it much easier for artists to directly record/produce, distribute, and market music to consumers. However, this benefit has a clear downside as well: A deluge of songs now hits the market daily, making it more difficult for any single artist to stand out,” Macker writes. “While minor labels could help these artists, the majors provide amplification along with larger budgets, access to other talent, and development tools. Many independent artists who make it out of the morass with a massive viral hit have ultimately signed to a major label to take the next step in their development.”

In short, while independent artists and labels have direct access to consumers unlike ever before, so does everyone else. Meaning that they’ve got to either rely on a combination of talent, timing, and luck to find success or join forces with major labels that have the resources to plug artists directly into a system that was built decades ago.

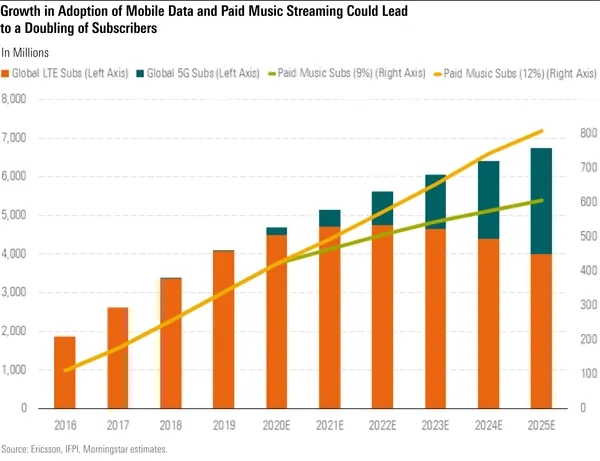

Morningstar’s research found that all three major labels have grown at various rates over the past five years and should continue to do so, especially as more people get access to 5G/LTE technology.

The paid music streaming music market will continue to grow over the next five years and Morningstar research projects that the number of paid subscribers to music streaming services like Apple Music, Spotify, and Tidal will double to 800 million by 2025.

While the report predicts that the music industry will see growth in various areas given the expansion of streaming services, it estimates an average annual top-line growth of 12.2%, specifically.

As younger listeners from around the world and new adopters of 5G/LTE add to the growth of music streaming as a format, the labels that have been on top of the industry for more than 50 years will continue to benefit most.

Keith Reid-Cleveland does not own (actual or beneficial) shares in any of the securities mentioned above. Find out about Morningstar’s editorial policies.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

© Copyright 2022 Morningstar, Inc. All rights reserved. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.