.hide-if-no-js { display: none !important; }

.hide-if-no-js { display: none !important; }

.hide-if-no-js { display: none !important; }  U.S. music industry revenue in 2019, 2020, and 2021. Photo Credit: RIAA

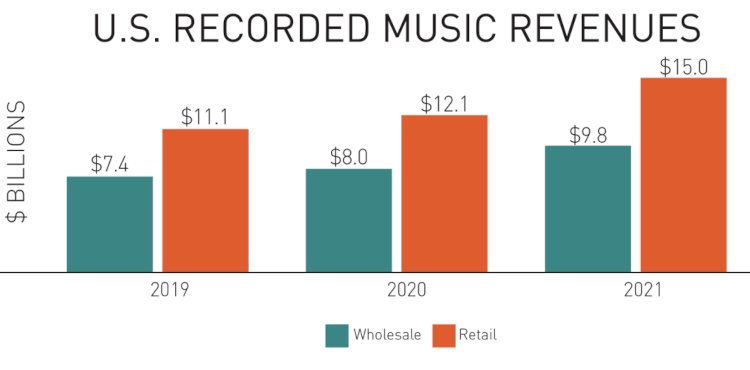

U.S. music industry revenue in 2019, 2020, and 2021. Photo Credit: RIAA

The RIAA published its latest yearend analysis today, and the document discloses off the bat that recorded music revenue in the United States came in at the aforementioned $14.99 billion for “estimated retail value” and at $9.8 billion for “wholesale value” in 2021. “Retail Value is the value of shipments at recommended or estimated list price,” the text elaborates. “Formats with no retail value equivalent included at wholesale value.”

Of course, certain items may ultimately sell for less than the “recommended or estimated list price” – meaning that the provided retail-value figure could be somewhat inflated from the worth of actual sales. Additionally, the RIAA itself acknowledged that 2021’s almost $15 billion in annual revenue, while technically the highest to date, is “37% below” that of 1999 when “adjusted for inflation.”

Physical products accounted for 11 percent of revenue in 2021 (up two percent from 2020), followed by four percent for digital downloads (down two percent YoY) and two percent for sync (the same percentage as 2020, but with a royalties increase of 14.2 percent, at $302.9 million).

On the streaming side (which reflects TikTok income for the first time), the breakdown indicates that paid music subscriptions in the U.S. reached an annual average of 84 million in 2021, up from 75.5 million in 2020 and 60.4 million in 2019. Needless to say, streaming services’ premium revenue has jumped in tandem with this subscribership hike. Ad-supported streaming, for its part, expanded by 46.7 percent YoY in 2021, to $1.76 billion, per the RIAA.

“Limited tier paid subscription” delivered $907.3 million in 2021 (up 26 percent YoY), whereas SoundExchange distributions approached $1 billion at $992.5 million (up 4.8 percent YoY). Notwithstanding a continued dip in downloads (down 11.7 percent YoY), U.S. fans still spent $256 million to own digital singles and $282.2 million to own digital albums in 2021.

The corresponding figure reached $1.04 billion in 2021 – the first time it’s topped $1 billion since 1986 – as units shipped improved from 23.7 million to 39.7 million. Meanwhile, CDs managed to generate $584.2 million last year (up from $483.3 million in 2020) as units shipped approached 47 million, up almost 50 percent YoY. 2021 marked the first year since 1996 that both CDs and vinyl enjoyed bolstered revenue from the prior reporting period, the 15th consecutive year of growth for vinyl, and the first YoY revenue increase for CDs since 2004.

And amid rumblings of a full-scale cassette resurgence, revenue attributable to “other physical,” including “CD Singles, Cassettes, Vinyl Singles, DVD Audio, [and] SACD,” quietly grew from $8.8 million in 2020 to $14 million in 2021.

Total failure of the Big Three Labels. The leadership of all 3 should be fired long ago. 37% lower than 1999!!!